The Million-Dollar Question: How Much Do You Need to Retire?

As retirement looms on the horizon for many, the daunting question of how much money is needed to live comfortably in those golden years is becoming increasingly pressing. While high-earning physicians may aim for a multi-million dollar nest egg, the average American’s retirement savings fall significantly short of their expectations. The stark reality is that while the perceived necessary retirement fund has ballooned to $1.46 million, the average savings amount to a mere $88,400.

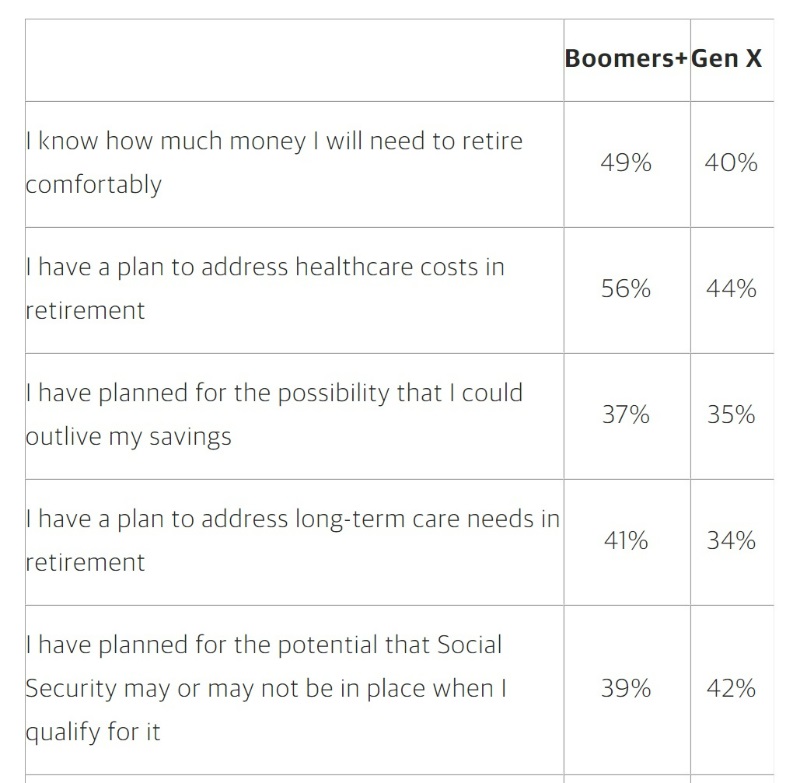

A Widening Gap in Retirement Readiness

The gap between what Americans believe they need for retirement and what they’ve actually saved is growing. Just last year, the target retirement fund was 15% lower, and despite this year’s average savings being slightly less than last year’s, the goal has surged. Inflation and the rising cost of living have pushed the ‘magic number’ for a comfortable retirement to record highs, leaving many to wonder how they’ll bridge this financial chasm.

Generation Z Gets a Head Start on Savings

In a silver lining to the retirement savings cloud, Gen Z appears to be more proactive, starting their savings journey at age 22, a full nine years earlier than previous generations. However, with a third of Gen Z and Millennials anticipating a lifespan of 100 years, the longevity of their savings is a growing concern.

High Earners Not Immune to Savings Shortfall

Even those with substantial incomes are not safeguarded against the retirement savings shortfall. Wealthy individuals with over $1 million in assets still find themselves far behind their retirement goals, with an average saved amount that doesn’t come close to their expected needs.

Financial Insecurity on the Rise

Financial insecurity is at an all-time high, with a third of Americans expressing concern over their fiscal health—a significant increase from previous years. Despite this, many are reluctant to cut back on lifestyle expenses such as dining out, holidays, and entertainment, potentially exacerbating the savings gap.

Strategies for Bolstering Retirement Savings

For those feeling the pinch, experts suggest several strategies to shore up retirement funds. From maximizing retirement accounts to making budget adjustments, every dollar saved now can contribute to a more secure future. Selling underused high-value assets and redirecting those funds into investments, as well as taking advantage of tax breaks, are additional tactics to consider.

Living Standards and Part-Time Work in Retirement

Lower-income individuals may face a different retirement reality, with many expecting to continue working part-time to supplement their income. Family support structures and the reliance on Social Security and Medicare also play a role in managing retirement expectations and assets.

Even High Earners Must Plan Carefully

No matter the size of one’s income, a luxurious retirement is not guaranteed without prudent financial planning. Consistent saving and smart investment choices throughout one’s career are essential to achieving the desired comfort level in retirement.

Retirement Planning Resources

For those seeking guidance on starting their retirement savings or evaluating the right time to retire, resources abound. Expert opinions and tailored advice can help pave the way to a more secure financial future.

Money and Nostalgia in Pop Culture

The stress of financial planning and the yearning for simpler times are themes that resonate across generations, as reflected in popular music like Twenty One Pilots’ “Stressed Out.” The song captures the essence of a generation grappling with financial pressures and the nostalgia for a carefree youth.

The Community Weighs In on Retirement Savings

Conversations about retirement savings strategies are robust and varied, with opinions on frugality and investment often polarized. How much one needs to retire comfortably remains a hot topic, with many seeking advice on how to stay on track or catch up if they’re falling behind.

As the retirement landscape continues to evolve, individuals are encouraged to assess their financial strategies and adapt to ensure a secure and enjoyable retirement. The question remains: are you on track with your retirement savings, and if not, what steps will you take to get there?

Did you miss our previous article…

https://pardonresearch.com/?p=45949