A Journey into Financial Literacy

Embarking on a quest to enhance financial knowledge, the path repeatedly led to one name synonymous with academic retirement research: Wade Pfau. His extensive work probes deep into retirement planning, challenging established norms and offering unconventional support for financial products often met with skepticism, like whole life insurance and annuities.

The Creative Genius of Pfau’s Retirement Vision

Wade Pfau’s insights into the emotional landscape of retirees are nothing short of creative genius. His unique perspective has earned the respect of industry leaders, who acknowledge the merits of his safety-first versus probability-based approach to retirement income. Pfau’s most recent innovation, the Retirement Income Style Awareness (RISA) tool, is a testament to his dedication to understanding retirement behavior and spending.

An Inside Look at RISA

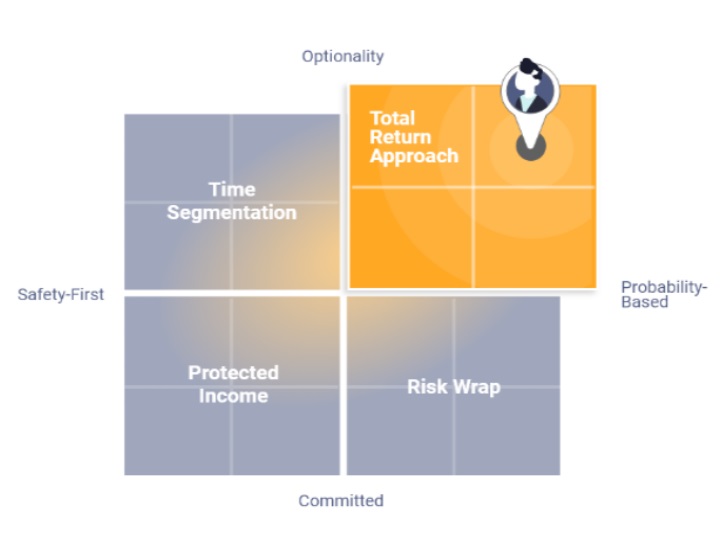

RISA, which stands for Retirement Income Style Awareness, is a tool designed to gauge a retiree’s preferences for funding their post-work years. It goes beyond simple risk tolerance, offering a nuanced approach that considers a retiree’s feelings towards safety versus probability and commitment versus optionality. By plotting these preferences on a matrix, retirees can find themselves in one of four quadrants, each with its distinct approach to managing retirement income.

Personalizing Retirement with RISA

Understanding where you fit within the RISA matrix involves answering a series of questions that focus on your attitudes towards retirement income. These questions help pinpoint your position on the spectrums of safety first versus probability and commitment versus optionality, ultimately placing you within one of the four quadrants that best aligns with your retirement income style.

The Quadrants of Retirement Income Style

Each quadrant of the RISA framework represents a different approach to retirement income. From the total return approach, which seeks to maximize potential spending by tolerating swings in income, to the time segmentation strategy, which balances the need for stable income with the desire for investment flexibility, RISA offers a tailored retirement planning experience.

Controversy in Retirement Solutions

While RISA suggests a variety of annuities as potential solutions for different retirement income styles, it’s important to be wary of the so-called “bad” annuities. These products, often laden with high fees and commissions, can erode wealth rather than secure it. It takes a discerning eye, akin to that of retirement guru Wade Pfau, to navigate these complex financial waters without succumbing to the pitfalls of expensive and restrictive financial products.

Maximizing Retirement with RISA

Despite the controversy around certain annuities, the RISA framework remains a valuable tool for those seeking a comprehensive retirement plan. It helps retirees and pre-retirees alike to structure their asset allocation and withdrawal strategies, make informed decisions about annuities, and create a retirement plan that aligns with their unique income style. The insights gained from RISA can empower retirees to build a financial plan that ensures happiness and security in their golden years.

Join the Conversation

Have you explored the RISA framework for your retirement planning? Whether you’ve found it to be an innovative guide or have reservations about the promotion of certain annuities within its structure, your experiences and opinions are valuable to the ongoing discussion about preparing for retirement. Share your thoughts and engage with others on this critical aspect of financial well-being.

Did you miss our previous article…

https://pardonresearch.com/?p=3551