The Allure and Risk of Bitcoin Investment

Bitcoin has been a topic of intense discussion and speculation for over a decade. Despite not personally investing in cryptoassets, observing Bitcoin’s journey has been intriguing. It’s a mix of attractive qualities and significant drawbacks that we’ll examine today.

Neutral Ground in the Bitcoin Debate

Contrary to what some may think, I don’t harbor an anti-Bitcoin stance. Rather, I consider myself neutral, acknowledging the cryptocurrency’s potential benefits without being blinded by them.

Bitcoin’s Volatility and Its Impact on Returns

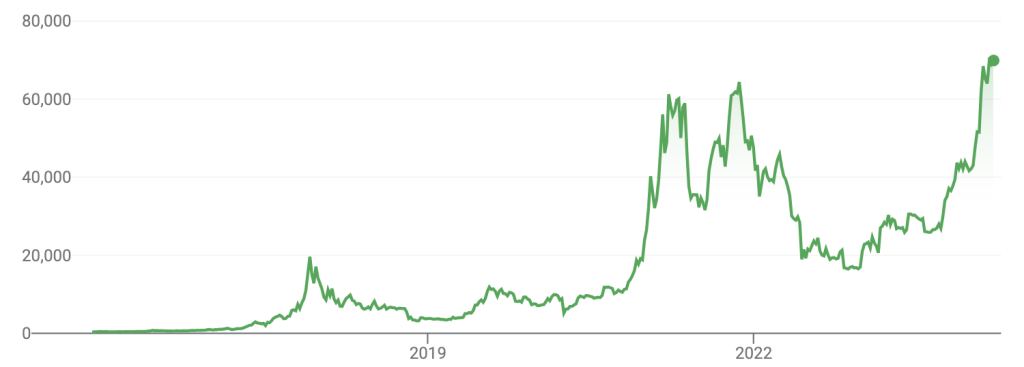

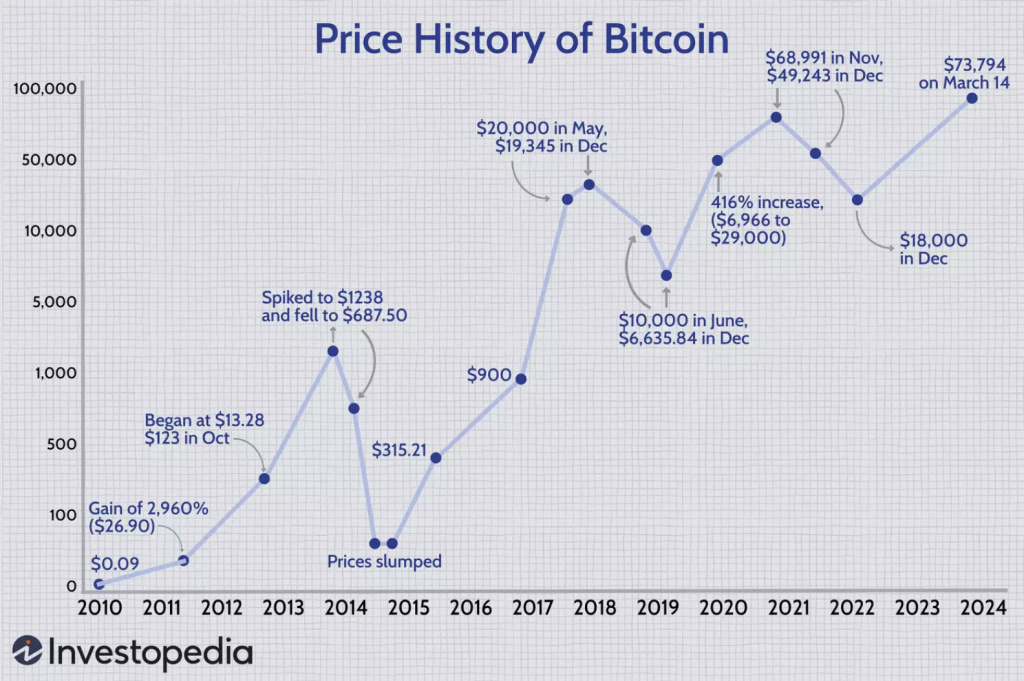

Discussing Bitcoin’s returns requires a timestamp due to its notorious volatility. As of April 11th, 2024, Bitcoin stands at $69,813.40. Those who invested before November 2020 or during the mid-2022 to late 2023 period have seen impressive returns, raising questions about whether Bitcoin should be regarded as an investment or a speculative tool.

The Tax Efficiency of Bitcoin

One of Bitcoin’s most appealing features is its tax efficiency. Unlike other assets, Bitcoin offers advantages such as a step-up in basis at death and long-term capital gains tax rates after a year of ownership, which can significantly enhance the value of holdings over time.

Bitcoin’s Use Cases and Portability

While many proposed use cases for Bitcoin have not materialized, its portability stands out. For those needing to move assets quickly and discreetly, Bitcoin’s ease of transfer is unparalleled. This advantage, however, does not extend to Bitcoin spot ETFs, though they offer their own conveniences.

The Downsides of Bitcoin Investment

Despite its potential, Bitcoin remains a speculative asset with no inherent value generation, such as earnings or dividends. Its value is solely dependent on selling at a higher price than the purchase price, which can lead to significant losses during downturns.

The Psychological Toll of Bitcoin’s Volatility

The extreme fluctuations in Bitcoin’s value can test even the most steadfast investors. The fear of loss can be just as compelling as the fear of missing out, making it difficult to hold onto the asset during market dips.

Security Concerns and Lost Bitcoins

Security remains a concern, with billions in cryptocurrency stolen or hacked in recent years. Moreover, a substantial portion of mined Bitcoins has been permanently lost, highlighting the risks associated with digital asset storage.

Bitcoin’s Identity Crisis

Initially heralded as a new currency, Bitcoin has not replaced traditional money and likely won’t. Its limited practical applications beyond speculation cast doubt on its future as a mainstream currency.

Investing in Bitcoin: A Behavioral Gamble

Bitcoin’s resemblance to gambling, with its highs and lows, can negatively affect investing behavior. Successful long-term investing depends more on the investor than the investment, and Bitcoin’s inclusion in a portfolio could hinder an investor’s decision-making skills.

Personal Stance and Investment Advice

While recognizing Bitcoin’s potential, I view the risks as outweighing the benefits and thus refrain from investing. For those considering Bitcoin, a modest allocation of around 5% of your portfolio is advisable to balance belief in its potential with the reality of its volatility.

Join the Conversation

What’s your take on Bitcoin? Does it have a place in your investment strategy, or do you share concerns about its viability? Share your thoughts and experiences with Bitcoin’s recent trends in the comments below.

Did you miss our previous article…

https://pardonresearch.com/?p=3546