Understanding the Safe Withdrawal Rate

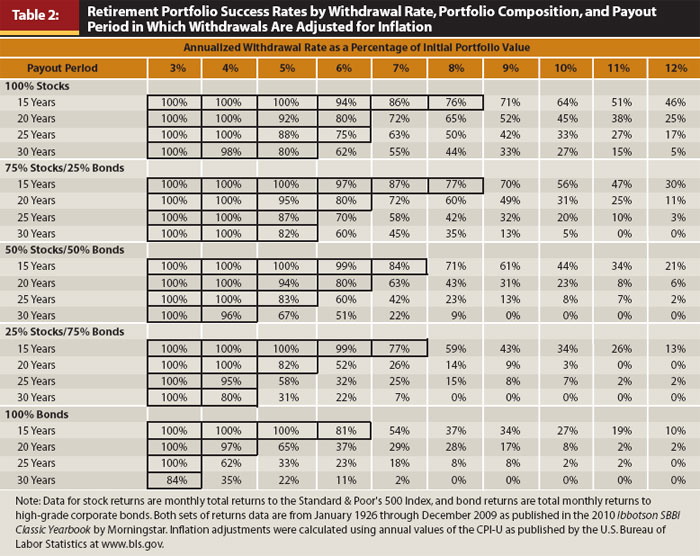

Retirees often grapple with the question of how much they can afford to withdraw from their portfolios each year without the risk of depleting their funds. The concept of a “safe withdrawal rate” (SWR) is meant to offer guidance, though it is not a guarantee. It suggests a retiree can withdraw a certain percentage of their portfolio annually, typically adjusted for inflation, with a reasonable expectation that their savings will last.

The Origins of the 4% Rule

The idea of the SWR gained traction with the Trinity Study in the 1990s, which challenged the then-common advice that retirees could safely spend 8% of their portfolio each year. The study introduced the concept of Sequence Of Returns Risk (SORR), highlighting the danger of withdrawing too much during market downturns. Based on historical data, a 4% withdrawal rate was found to be generally safe, giving rise to the popular “4% Rule”.

Engineers and the Quest for Precision

While the SWR provides a useful benchmark, there’s a tendency, particularly among those with a penchant for data and precision, to over-analyze and seek an exact figure down to the decimal. This quest for precision can be counterproductive, given the inherent unpredictability of market returns and the limited scope of historical data.

Challenging Pessimism in Retirement Planning

Despite the historical resilience of a 4% withdrawal rate, even in the face of economic downturns and crises, there’s a current trend towards extreme caution. Some suggest withdrawal rates as low as 2%, driven by a pessimistic outlook on future market performance. However, such conservative estimates may be unnecessarily restrictive and overlook the potential for continued economic growth.

Adjusting Withdrawal Rates: A Practical Approach

A more pragmatic strategy for retirees might be to start with a 4% withdrawal rate and adjust as necessary, based on actual portfolio performance and changing personal circumstances. This approach allows for flexibility and responsiveness to market conditions, rather than adhering rigidly to a predetermined figure.

The Role of Annuities and TIPS

For those seeking greater security, Single Premium Immediate Annuities (SPIAs) and Treasury Inflation-Protected Securities (TIPS) can provide more predictable income streams. These options can complement a flexible withdrawal strategy, reducing anxiety about market volatility and ensuring a steady flow of funds.

Retirement Duration and Withdrawal Rates

The suitability of a withdrawal rate also depends on the length of retirement. For example, a higher rate may be sustainable over a shorter retirement span, while a lower rate might be more appropriate for those retiring early. Understanding life expectancy and personal health can inform more tailored withdrawal strategies.

A Balancing Act: Spending, Saving, and Leaving a Legacy

Ultimately, retirement planning is a balance between enjoying the present and preserving enough for the future. While the SWR offers a guideline, individual circumstances will dictate the most appropriate approach. Retirees should consider their desired lifestyle, potential healthcare costs, and the legacy they wish to leave when determining their spending plan.

Conclusion: Embracing Flexibility in Retirement

As retirees navigate their post-work years, the key to financial peace of mind may lie in a flexible approach to spending. By starting with a general benchmark like the 4% Rule and adjusting based on real-world experience, retirees can enjoy their savings while mitigating the risk of running out of money. The debate over the perfect SWR may continue, but the best plan is likely one that adapts to life’s inevitable changes.

Join the Discussion

What’s your take on the SWR debate? Do you have a retirement spending plan in place? Share your thoughts and strategies in the comments below.

Did you miss our previous article…

https://pardonresearch.com/?p=2760