The Power of Frugality Post-Training

For professionals stepping into high-income roles, the advice is simple yet profound: maintain your modest lifestyle for 2-5 years post-training. This disciplined approach can lead to a significant wealth accumulation, enabling you to clear debts, save for a house, and secure your financial future. The transition from a resident’s income to a higher salary offers a unique opportunity to build a solid financial foundation without succumbing to lifestyle inflation.

Avoiding the Pitfalls of Lifestyle Explosion

While a slight increase in spending post-residency is expected, caution is advised against a drastic lifestyle upgrade. A controlled, moderate increase in spending can prevent the loss of a prime opportunity for wealth creation. The challenge is to resist the temptation of quadrupling your expenditures, a common trap that can lead to financial instability and regret.

Personal Spending Insights from a Frugal Perspective

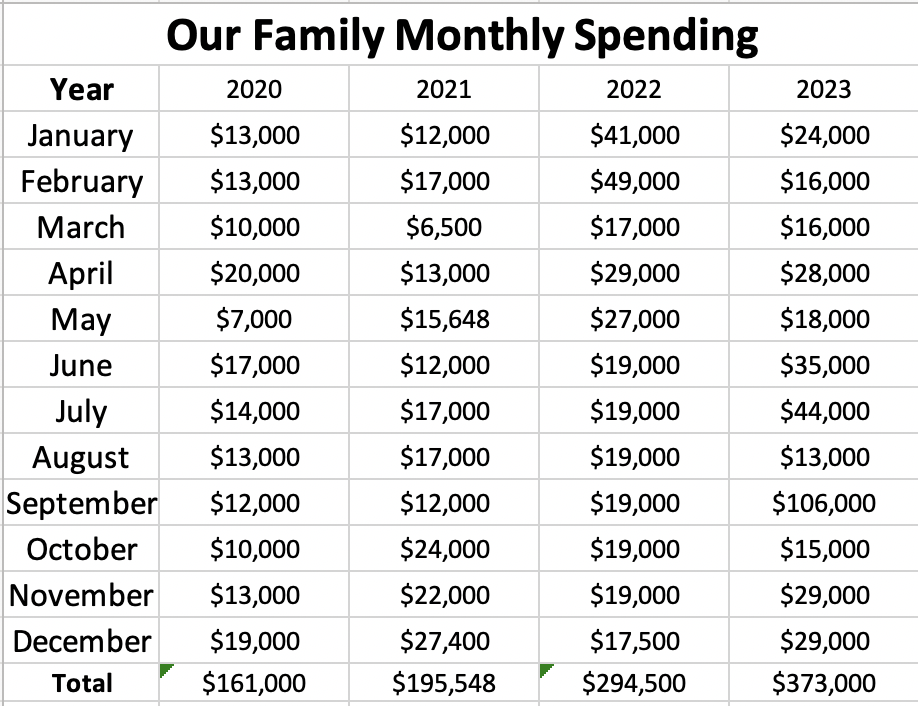

Reflecting on personal spending habits, it becomes clear that even those who value frugality can learn to spend more without compromising happiness. Over time, the strict budgeting of the past can evolve into a more flexible approach, focusing on tracking cash flow rather than imposing spending limits. This shift can lead to increased spending, but it’s essential to ensure that the spending aligns with true happiness and satisfaction.

Understanding the Challenge of Controlled Spending

For those who find it difficult to spend less, the key is to establish a budget with incentives. Allocating funds for spending can help manage the desire to splurge, with unspent money going towards a charity or other predetermined cause. Removing spending constraints can lead to more spending, which is why it’s crucial to have measures in place if financial goals include reducing expenses.

Adapting to Financial Volatility

Financial plans must account for the natural variability in monthly spending. By keeping fixed expenses at a manageable proportion of income, you can navigate through the ups and downs without jeopardizing your financial stability. It’s vital to plan for this volatility to avoid becoming overwhelmed by unexpected costs.

Money as a Tool, Not the Goal

Money should be viewed as a tool to facilitate a good life rather than the ultimate objective. It’s about finding the right balance between saving, investing, and spending on personal well-being. For those who struggle with spending, delegating payment responsibilities can alleviate the stress associated with costs and enhance the enjoyment of purchases.

Planning for Inflation in Your Financial Strategy

Inflation is an inevitable factor that must be incorporated into any financial plan. As the cost of living increases, so will nominal spending, even without changes in lifestyle. A sound financial strategy will anticipate and accommodate these increases to prevent future financial strain.

Achieving The Good Life

The ultimate financial goal is to lead a life free from monetary stress, with the ability to enjoy a few luxuries, support others, and retire comfortably on your terms. By adhering to a disciplined financial approach, you can achieve this “Good Life,” ensuring long-term happiness and security.

Join the Conversation

Have you experienced a lifestyle explosion? How do you manage your spending to avoid financial pitfalls? Share your experiences and strategies in the comments below to contribute to the discussion on achieving financial success while avoiding the traps of excessive spending.

Did you miss our previous article…

https://pardonresearch.com/?p=3693