Exploding Popularity of SAVE

As the latest addition to student loan repayment options, the Saving on a Valuable Education (SAVE) repayment plan has seen a surge in popularity, with nearly 8 million borrowers opting in. Offering lower payments and an interest subsidy, SAVE has its perks, but it’s not a one-size-fits-all solution. With the sunset of the Pay As You Earn (PAYE) scheme on the horizon, it’s time to weigh your options carefully.

The PAYE Countdown

PAYE, a scheme once favored by many, particularly medical professionals, for its payment caps and the ability to file taxes separately from a spouse, is on its way out. With its termination set for July 1, 2024, those eligible must enroll promptly to secure their place before the door closes.

Understanding Income Driven Repayment Plans

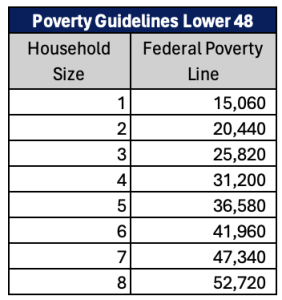

Income Driven Repayment (IDR) plans are a cornerstone of student loan repayment strategies, with four major options to consider: SAVE, PAYE, IBR (both old and new), and ICR. Each plan calculates payments based on a percentage of your discretionary income, which is your Adjusted Gross Income (AGI) minus a specified percentage of the poverty threshold, depending on your family size.

Eligibility and Payment Calculations

Eligibility for these plans often hinges on the concept of ‘partial financial hardship,’ where your IDR payment would be lower than what you’d pay on a standard 10-year repayment plan. This is particularly relevant for high-earning professionals like doctors during their training years. It’s vital to remember these details as the selection of your repayment plan could significantly impact your financial future.

The Impending Changes

With the impending phase-out of PAYE and changes to the ICR plan, which will soon be exclusive to parent borrowers, the landscape of student loan repayment is shifting. Borrowers need to strategize wisely and may need to act before July 1, 2024, to secure the most beneficial plan.

Strategizing for High Earners

For those whose income is expected to soar well beyond their student debt, the absence of a payment cap in SAVE could prove costly. In such cases, PAYE or New IBR may offer a more favorable payment structure. As PAYE is set to disappear for new entrants, the time to consider this option is now.

SAVE’s Interest Subsidy: A Game Changer?

A defining feature of SAVE is its interest subsidy, which prevents your loan balance from escalating. This could be particularly advantageous for early-career professionals or those with a debt-to-income ratio skewed towards the former. However, for those anticipating a significant income increase, other plans with payment caps could be more prudent.

Scenarios to Consider

Various scenarios can play out depending on your marital status, income level, and career trajectory. For a high-earning doctor, PAYE might offer substantial savings over the next five years compared to SAVE. For a resident doctor, starting with New IBR could lead to significant savings, especially if they switch from SAVE before a substantial income hike. Dual-income households might find that SAVE offers the best savings over time, especially if they’re aiming for loan forgiveness.

Repayment Strategy Beyond Forgiveness Tracks

If you’re not pursuing forgiveness programs like PSLF, SAVE still stands as a solid repayment method, provided that refinancing doesn’t offer you a better interest rate. With the current financial climate, those who have previously refinanced may regret missing out on federal initiatives that followed. Hence, a cautious approach is advised when considering refinancing options.

Seeking Expert Guidance

Choosing between SAVE, PAYE, and New IBR is a crucial decision that will shape your financial obligations for years to come. Given the complexity of student loan repayment options, professional advice can be invaluable in navigating this maze. StudentLoanAdvice.com experts are available to help you chart the most effective course towards financial freedom.

Have Your Say

Are you considering a switch in repayment plans, or are you concerned about hitting the payment ceiling? Share your thoughts and strategies below and join the conversation on student loan repayment planning.

Did you miss our previous article…

https://pardonresearch.com/?p=3528