It’s no secret that the political landscape can be as unpredictable as the weather, and right now, all eyes are on the Inflation Reduction Act (IRA) as it finds itself in the crosshairs of former President Donald Trump. With the November elections looming, the threat of a GOP sweep could spell trouble for President Biden’s landmark climate legislation. But, as I’ve mentioned before, it’s not all doom and gloom. There’s a growing political force brewing, one that’s rooted deep in Republican territories, which could make it a tough sell to simply repeal or weaken the IRA. This new dynamic might not just protect the current law but could also pave the way for a broader embrace of clean energy initiatives in the future.

Why Subsidies Are Sticky Business

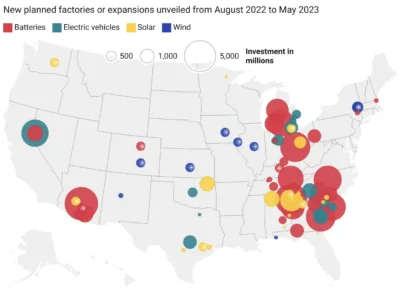

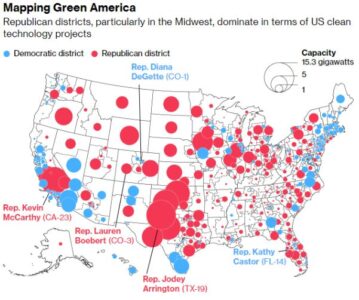

When it comes to subsidies, getting rid of them is often easier said than done. The geographical distribution of the IRA’s spending is a case in point. The law has been channeling funds into Republican strongholds like Georgia and battleground states like Michigan. We’re talking about big bucks here, with multi-billion dollar investments for constructing battery and electric vehicle factories. This isn’t just a map from the Citizens’ Climate Lobby; it’s a map of potential political minefields for any opponent of the IRA.

Unexpected Allies in the Environmental Crusade

Who would have thought that subsidies for nuclear power and carbon capture would rally support from corners not typically associated with environmental laws? But here we are, witnessing a strategic shift that’s starting to bear fruit.

Just take a look at the recent developments. On a Tuesday not too long ago, over 300 leaders from the clean energy sector penned a letter to Congress, practically imploring them to stand united behind the IRA. They didn’t mince words either, calling a potential repeal an “economic and national security disaster.” They painted a grim picture of the fallout: American businesses in jeopardy, workers laid off, and half-finished factories – not exactly the kind of future anyone’s hoping for.

And it’s not just industry insiders who are speaking up. The CEO of Shell Oil threw his weight behind the IRA, praising its effectiveness in attracting investments across the political divide. He underscored the job creation and the foundation of new industries that the IRA supports. His plea? Legal certainty to enable companies like Shell to commit to long-term investments with confidence.

Political Consensus on Clean Energy Tax Credits?

During an energy summit hosted by Politico, a surprising narrative emerged. GOP lawmakers, ranging from staunch fossil fuel advocates to conservative climate change champions, expressed a desire to maintain the energy tax credits established by the IRA, even in the event of a Trump comeback.

This isn’t a one-off sentiment either. Just a couple of weeks prior, reports surfaced about two trade groups, traditionally Republican backers – the U.S. Chamber of Commerce and the American Petroleum Institute – gearing up to defend the IRA. This is particularly noteworthy given their initial opposition to the Democrat-led bill. Proponents of the IRA are quick to highlight its economic benefits, citing over 500 new projects, which they claim will create upwards of 270,000 jobs and attract more than $350 billion in investments.

No Guarantees in the Political Arena

Despite the mounting support, the future of the IRA is far from certain. Ideological battles could still tip the scales. Conservative activists and Trump himself remain staunchly against the legislation. What’s clear, however, is that repealing the IRA won’t be a walk in the park, thanks to the solid economic backing it has garnered. Should the Republicans sweep the next elections, the IRA may still stand a chance at survival, bolstered by the very interests it has helped to flourish.

As we look ahead to the 2024 elections and the evolving climate politics, one thing is certain: the debate over the Inflation Reduction Act will be a key battleground in the struggle to define America’s environmental future.

Did you miss our previous article…

https://pardonresearch.com/?p=49185