The Unthinkable Reality of Financial Deception

It’s a hard pill to swallow, but even the most financially literate among us can fall prey to cunning fraudsters. In a candid account, a seasoned ER physician with an MBA and a portfolio of businesses shares his sobering experience of being scammed out of $75,000 by a seemingly trustworthy dentist.

The Hidden Vulnerability of Medical Professionals

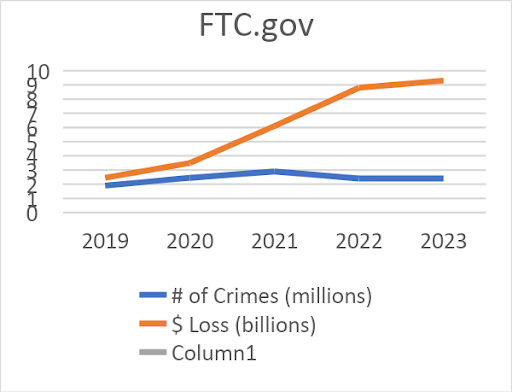

While it might seem counterintuitive, doctors and other medical professionals are not immune to being duped. Despite their expertise in their field, their busy schedules and lack of formal business training make them prime targets for investment fraud. With billions lost annually in the US, this tale underscores the need for heightened vigilance in the medical community.

A Charismatic Con Artist Unveiled

It all began on a pleasant winter day in Austin, Texas, where a meeting with a dentist named “Trent” unfolded under the guise of business growth. Trent’s personal and professional story, coupled with his apparent humility and business acumen, painted the picture of a man who had learned from past mistakes and was on the rise once again. Little did the doctor know, this encounter would lead to a costly investment blunder.

The Lure of a Profitable Investment

Despite initial hesitance, the physician was drawn into investing in Trent’s dental clinics, swayed by the success stories of friends and the fear of missing out on a lucrative venture. A combination of trust in his peers, a lack of due diligence, and the seductive promise of a profitable business led to a substantial financial loss when Trent’s fraudulent scheme was eventually uncovered.

Understanding the Psychology of Fraud

Why do well-educated, financially savvy individuals still fall victim to scams? Research suggests that a blend of overconfidence, trust in professional status, and the sudden access to investment opportunities without the requisite experience can create the perfect storm for fraudsters to exploit. For this physician, a combination of these factors proved to be his downfall.

The Harsh Reality of Financial Fraud

The devastating impact of financial fraud extends beyond monetary loss. Victims often struggle with shame, guilt, and a sense of betrayal. For this doctor, although his financial stability lessened the blow, the psychological effects were undeniable. The experience serves as a stark reminder that the consequences of fraud can be far-reaching, affecting mental health and personal relationships.

Lessons Learned and Steps to Safeguard Your Investments

In the aftermath of the scam, the physician reflects on the critical errors that led to his victimization. From the allure of affinity fraud to the dangers of FOMO and the critical need for due diligence, he shares valuable insights to help others avoid similar pitfalls. Diversification, self-education, and seeking advice from trusted advisors are among the strategies emphasized to protect oneself from financial deceit.

Final Thoughts: Vigilance Against Investment Scams

The story concludes with a sobering reality check: no one, regardless of income or education, is immune to investment fraud. Recognizing the potential for deception and taking proactive measures to verify investment opportunities are essential steps in safeguarding one’s financial future. As the doctor’s experience illustrates, staying informed and cautious is key to avoiding the clutches of modern-day con artists.

In sharing his story, the physician hopes to shine a light on the often-overlooked risk of financial fraud within the medical profession and beyond. By acknowledging vulnerability and arming oneself with knowledge, it’s possible to navigate the investment landscape with greater confidence and security.

Did you miss our previous article…

https://pardonresearch.com/?p=28111